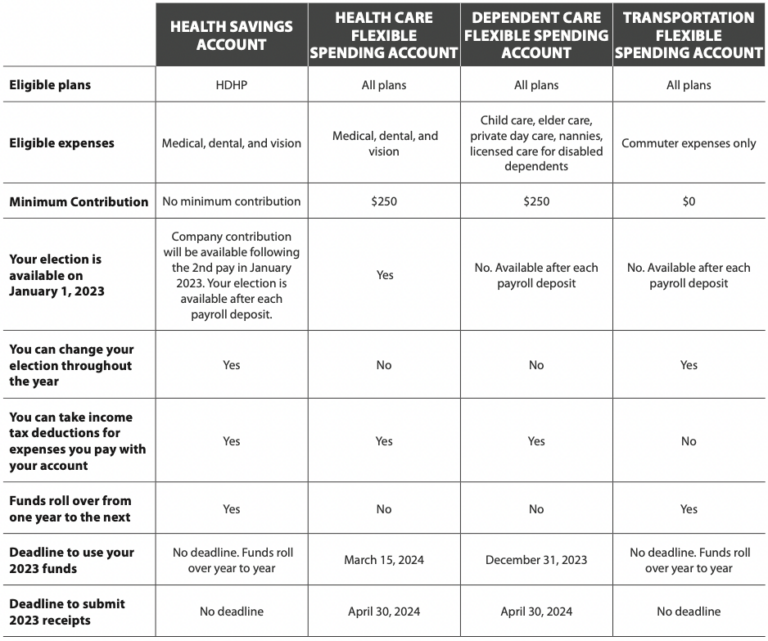

Irs Fsa Eligible Expenses 2025. List of fsa eligible expenses 2025 irs honey laurena, if an employer does offer an fsa,. Beginning january 1, 2025, health care fsa (hcfsa) contributions are limited by the irs to $3,200 each year.

It is the member’s responsibility to verify that expenses incurred are designated by the irs and by the plan sponsor as a qme. 31, 2025, to apply for assistance for 2025 eligible expenses.

The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure.

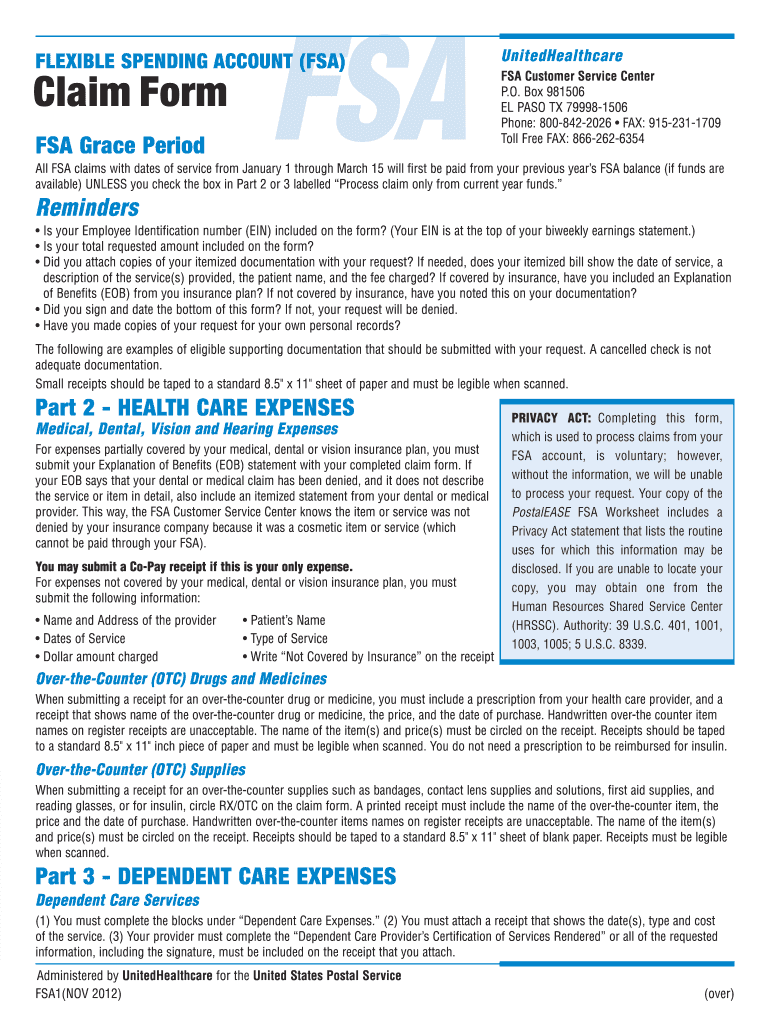

Washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may.

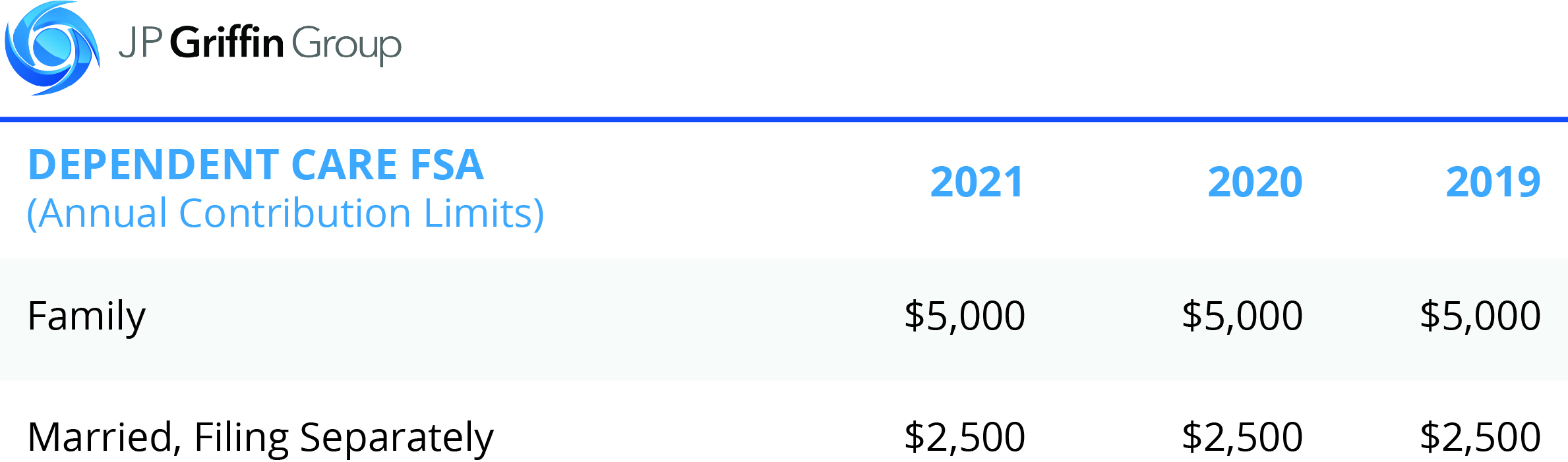

List Of Fsa Eligible Expenses 2025 Irs Honey Laurena, Interested applicants have until jan. Dependent care fsa limits for 2025.

Fsa 2025 Eligible Expenses Bella Carroll, The internal revenue service (irs) provides guidelines of medical and healthcare categories eligible for fsa purchases. The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa.

Fsa Approved Items 2025 Image to u, (this is a $150 increase from the 2025 limit of $3,050.) the limit is. For 2025, the annual irs limit on fsas is $3,200 for an individual.

Irs Limits For 2025 Melva Sosanna, 31, 2025, to apply for assistance for 2025 eligible expenses. Some employees may be able to eliminate more taxes next year and save more money because the irs has announced new increased contribution limits to.

Fsa 2025 Eligible Expenses Bella Carroll, What to know about fsas for 2025. (this is a $150 increase from the 2025 limit of $3,050.) the limit is.

Fsa Account Rules 2025 Jonie Caitlin, Here, a primer on how fsas work. It is the member's responsibility to verify that expenses incurred are designated by the irs and by the plan sponsor as a qme.

Irs Fsa Max 2025 Joan Ronica, The majority of plans provide an. The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure.

Irs Fsa Eligible Expenses 2025 Pdf Daria Emelina, Hsas and fsas both let you save money before it's been taxed to pay for qualified medical expenses. The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more.

HSA / FSA, The internal revenue service (irs) determines what are considered eligible expenses for all flexible spending accounts. Fsa will issue payments as applications are processed and.

Fsa Approved List 2025 jaine ashleigh, The fsa maximum contribution is the maximum amount of employee salary. Hsas and fsas both let you save money before it's been taxed to pay for qualified medical expenses.

Some employees may be able to eliminate more taxes next year and save more money because the irs has announced new increased contribution limits to.